Part I

Part I

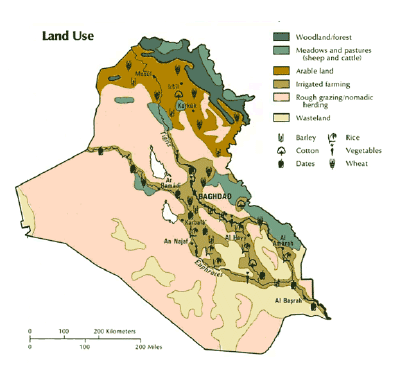

As Iraq moves through its next developmental phase following a couple of democratic elections, its economy stands at a pivotal point in time. Its path is clear; it must move towards progress and development. In this endeavor,

it can look to previous examples of economic development across the globe. It can look to the development of the Chinese economy under Deng Xiaoping during the 1970s and the recent growth of Dubai. Iraq must create and carry out a multi-faceted plan for economic development at a time when the global economy is recovering and major shifts in global thinking are occurring. If a democratic Iraq is to progress in these times, its economy must progr

ess and prosper alongside other facets of the country's make-up. As such, the Al-Iraqiya Coalition has focused on the following elements of economic progress. Individually, each element will not be enough to push Iraq forward. Together, they will lead to Iraq's advancements and success.

Security, Safety, and Stability

These factors cannot be separated from one another and stand amongst the most important elements in Iraq's development. Until security, safety, and stability are attained in Iraq, political and economic development of the country will be at a standstill. A defense budget guaranteeing these elements is essential for growth. Iraqi military, security, and police forces must be fully competent and efficient in order to guarantee these factors in the new Iraq. Without this, foreign investment, international trade, tourism, construction, and other key factors for economic development will be stifled. Iraqis and foreigners alike must be able to work and carry on day-to-day business without fear of attack. Thus, security, safety, and stability in Iraq are a necessity.

Foreign Investment

Foreign investment stands as a historical indicator of third world economic development. For example, prior to the 1970s, China had a poor and insignificant economy as compared to the industrialized world. The reforms instituted by Deng Xiaoping revolutionized China and have brought it to global preeminence. One statistic alone is representative of this: its foreign direct investment stood at $19 billion roughly 20 years ago and grew to $300 billion in a period of ten years as a direct result of the economic reforms instituted by Deng. The impact of foreign investment on Chinese economic growth cannot be ignored and stands as one of the primary triggers of its development.

Attracting foreign investors ranging from individuals to multinational corporations and governments is vital. The inflow of capital to certain industries from foreign direct investment is an absolute necessity as most sectors are in their infancy. Investors shall be allowed to

- o create a wholly owned subsidiary or corporation

- o purchase stocks of an existing entity

- o gain control of an entity through a merger acquisition

- o participate in joint venture with other foreign or domestic investors.

The key to ensuring new and continued foreign investment in Iraq is government assurance that foreign investors' assets, facilities, and employees will be safe and secure. As in any industry, investors are looking for optimal returns on risk-averse investments. For this reason, incentives for foreign investors to come in on joint ventures with Iraqi businesses shall be offered. This will bring in necessary capital while strengthening and developing the structure and methods of Iraqi businesses. This will ultimately place Iraqi businesses in a competitive global market.

➢ Incentives

It will be prudent to provide incentives as a means of attracting such investors. Incentives can take many forms and the following methods tend to be the most salient

- lower corporate and income tax rates

- tax abatements

- preferential tariffs

- increased availability of loans

- land subsidies

- research and development funding

- temporary regulation derogation for projects

- free trade zones to tap into domestic, European, and Mediterranean regions

• preferred by investors

• would generate large economic centers in Iraq

• optimal zones include

• Nineveh Province

• the port cities in the south

• the major Iraqi cities

• free trade zones should promote

• construction, which would rely on attracting and utilizing foreign investment

• Iraqi-foreign joint ventures as well as others

• export-oriented products

• market-driven economic activities.

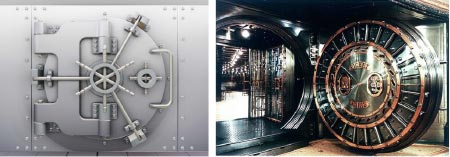

➢ Banking

Drawing banking institutions such as the World Bank and the Export-Import Bank of the US to Iraq would boost foreign direct investment. Providing these institutions with safe-havens would allow them to finance both Iraqi and foreign development. Their importance to economic development cannot be understated. In addition, properly developing Iraqi financial institutions is a prerequisite for success. These are vital in creating economic development programs to provide financing for Iraqi and foreign parties alike.

➢ Diaspora Attraction

The foreign investment ministry must strive to attract Iraqi citizens currently residing in Detroit, Chicago, San Diego, London, Sweden, Australia, and other major Diaspora communities. These dual-citizens are often professionals or entrepreneurs in their new homes. Attracting them to reinvest in the new Iraq and partake in its economic development is key, as this demographic holds both knowledge of Iraq and its way of life as well as Western economic experience.

Prepared by

Masoud Sam Yono

Edited and typeset by Uruk Shendaj

Reviewed & Approved by

EA Strategic Research & Consulting